Exness Deposit and Withdrawal

With hundreds of thousands of active traders, Exness stands as one of the largest online CFD and forex platforms, furnishing users with an extensive selection of financial vehicles and favorable trading terms.

As a premier forex broker, Exness operates under the oversight of seven esteemed regulatory bodies, including the UK’s Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CySEC), while leading the sector across an array of tradable assets. Ranging from cryptocurrencies to foreign exchange pairs, stocks, commodities, and more, Exness empowers traders with ample market access.

In addition to its vast market reach and product versatility, Exness excels in deposit/withdrawal flexibility. However, new traders need to grasp the ins and outs of funding accounts and withdrawing profits to effectively steer their Exness account.

This trading guide outlines key deposit and withdrawal protocols at Exness. We’ll explore expected timeframes for deposits and withdrawals, plus tips to expedite payouts.

Ways To Add and Take Out Money

Exness gives you several ways to fund your account and withdraw from it, each with its own minimum amount and processing times. Here are the approved methods for Exness traders:

- Bank Transfer

- Wire Transfer

- Credit/Debit Cards

- Skrill

- Neteller

Availability may vary by country, so it’s important to check what’s applicable in your region. When you log into your Exness account, you’ll find all the available options for your location. This ensures you’re always informed about what methods you can use and any regional restrictions.

Exness Trading Account Currencies

At Exness, the available base currencies vary with the type of trading account you opt for. In a standard account, you have the option to select from a variety of currencies, including:

ARS, AED, AZN, AUD, BND, BHD, CHF, CAD, CNY, EUR, EGP, GHS, GBP, HUF, HKD, INR, IDR, JPY, JOD, KRW, KES, KWD, KZT, MXN, MAD, MYR, NZD, NGN, OMR, PKR, PHP, SAR, QAR, RHB, SGD, UAH, USD, UGX, UZS, XOF, VND, ZAR.

It’s important to note that once you set your base currency for your trading account, it can’t be changed. Therefore, any deposits in a currency different from your base currency will come with conversion fees. This makes it essential to select the appropriate base currency to avoid extra costs. Nevertheless, you have the flexibility to open several Exness trading accounts with various base currencies, all under one personal area.

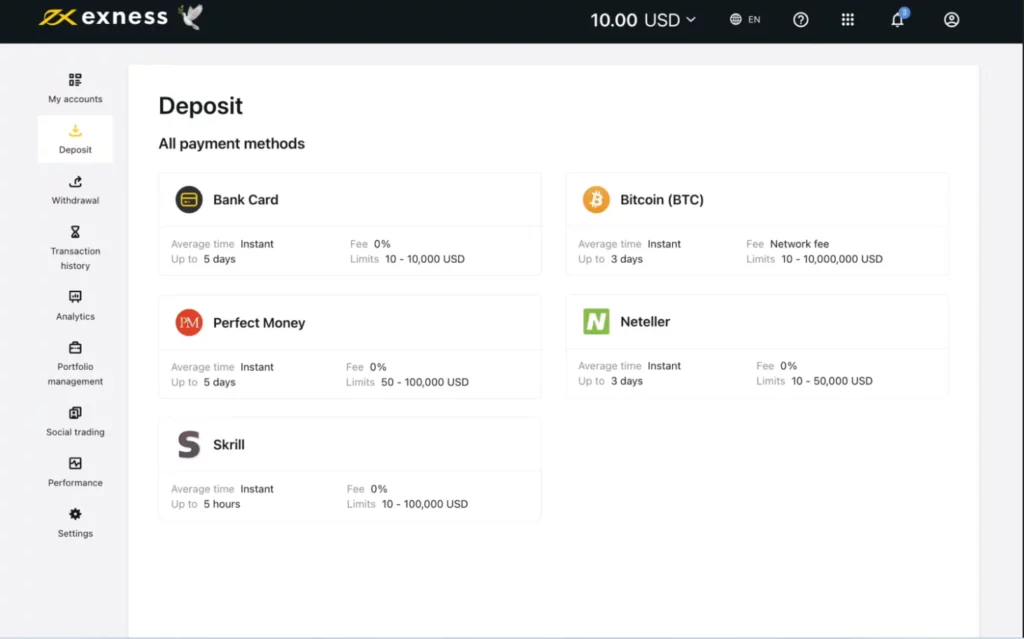

Exness Funding Methods

Adding money to your Exness trading account is straightforward, with several financial avenues available, such as:

- Credit/Debit Cards

Exness supports widely-used cards like Mastercard, Visa, and other major bank credit cards globally. For depositing, just input your card information and the desired amount. This method is quick and user-friendly, but be aware of possible transaction fees from your bank.

- E-wallets

Exness is compatible with e-wallets including Skrill and Neteller. Linking these e-wallets to your Exness account is simple, and deposits are instantaneous. However, some traders might have reservations about using third-party services.

- Direct Bank Transfers

You can also transfer money directly from your bank account to Exness using wire transfers or other bank transfer methods. For this, you’ll need to obtain the Exness banking information and execute the transfer either through your bank’s online system or by visiting a branch. Funds usually reflect in your Exness account within 72 hours. This method is free of Exness fees and allows for larger deposits.

How to Make Deposits in Exness

Adding funds to your Exness account is straightforward, regardless of the method you choose. Here’s a simple guide to get you started:

- Navigate to the Exness website or use their app, and log into your personal area. If you are a beginner, you will need to create an Exness account first.

- After logging in, select the “Deposit” option found in the side menu.

- Pick your preferred method of payment. Options include credit cards, bank transfers, and e-wallets.

- Fill in your Exness account number, your selected base currency, and the amount you wish to deposit, then click “Next”.

- Review your deposit information for accuracy and confirm your transaction.

- You’ll then be redirected to your payment provider’s page. Follow the on-screen instructions to complete the payment request. After confirmation, the provider will process your deposit, and the funds will soon be available in your account.

Limits and Fees for Exness Deposits

The minimum deposit amounts and potential fees vary based on your chosen method and account type. Different trading accounts have unique minimum limits, so it’s important to check your account’s profile and help section for specifics. For example, a standard account may have a minimum deposit requirement that varies depending on the payment method.

Exness minimum deposit amounts by payment method:

- Skrill: $10

- Credit/Debit Cards: $3

- Neteller: $10

Exness generally doesn’t impose deposit fees, but fees may be applied by your payment provider. Deposit processing times vary with the chosen method, though most are instant, reflecting the funds in your account seconds after the transfer is confirmed.

Benefits of Funding Your Account with Exness

Exness is committed to ensuring that funding your trading account is a hassle-free, fast, and secure process. Offering a variety of payment methods, Exness provides several benefits to its traders:

- You can add funds to your Exness account anytime, even on weekends and public holidays.

- Making deposits on Exness is generally free of charge. However, be aware that some banks, credit card companies, and external payment services may apply additional fees.

- Security is a top priority, as Exness prohibits anyone else from depositing into your account on your behalf.

- Many of the deposit options are immediate, allowing you to start trading within a few minutes.

- Exness’s standard online trading accounts are accessible with low minimum deposits, though this can vary depending on your chosen payment method.

Exness Deposit Bonus

While Exness offers a wide array of financial instruments, it does not provide deposit bonuses, aligning with their fundamental principles. Instead, Exness encourages earning through its partnership programs. You can participate in their broker program, potentially earning up to 40% of the revenue from each trader you refer to Exness, or make up to $1850 per client through their affiliate program.

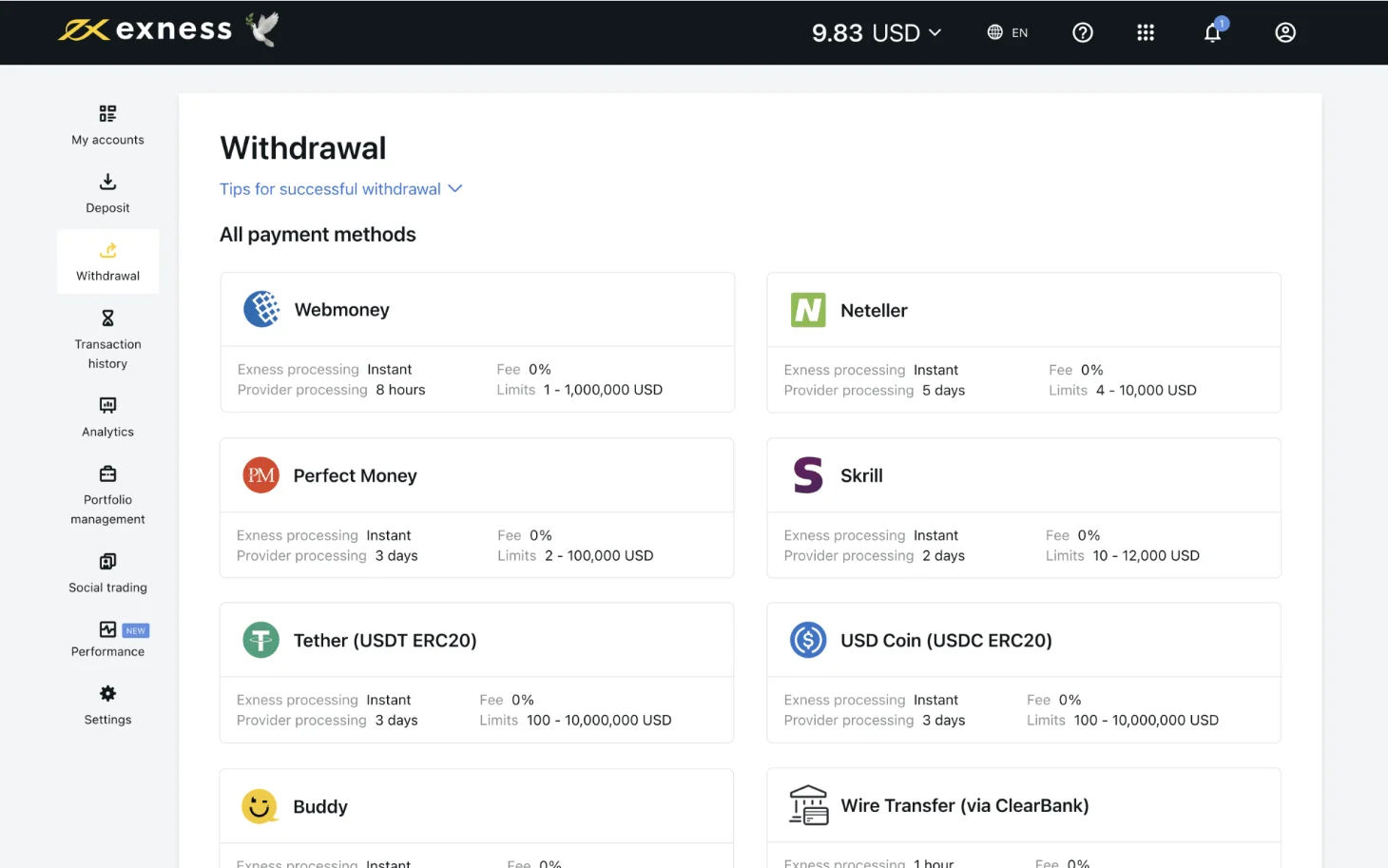

Exness Withdrawal Process

Withdrawing your earnings is an essential aspect of online trading, giving you access to your capital. At Exness, the methods for withdrawal are similar to deposit options and include:

- Bank Cards: You can use Visa, Mastercard, and other credit cards for withdrawals at Exness. These transactions are typically processed within one business day. Keep in mind there might be limits and some bank-related fees.

- Bank Transfers: Exness also allows you to withdraw directly to your bank account. Simply provide your bank details for the transfer. These transactions generally take 1-3 business days to complete and are free of Exness fees.

- E-wallets: For quick access to your funds, you can use e-wallets like Skrill or Neteller. Withdrawals to these are usually instant, but do consider potential fees from the e-wallet providers.

Steps to Withdraw Funds from Exness

Withdrawing funds from Exness is a straightforward process:

- Go to the Exness website and sign into your Personal Area.

- Select “Withdrawal” from the menu on the left side of the page.

- Choose your desired withdrawal method.

- Fill in your Exness account details, the currency, and the withdrawal amount, then click “Next”.

- Double-check the withdrawal information and enter the verification code you receive via SMS to confirm your transaction.

- Complete the process by providing details of the receiving account, like the account name and bank name.

Exness Withdrawal Time

The duration to receive your funds depends on the method you choose:

- Bank transfers: 1-7 days.

- E-wallets and bank cards: Instant – 24 hours.

Exness Rules and Fees For Taking Out Money

Exness has set rules to ensure fairness in withdrawals:

- Exness does not impose fees for withdrawals, but external service charges may apply.

- The minimum withdrawal amount varies; for e-wallets and bank cards, it’s generally low, whereas bank transfers require a higher minimum.

- Withdrawals that don’t comply with Exness’s policies may be declined.

Challenges with Exness Fund Withdrawals

Even though Exness aims for a hassle-free withdrawal experience, there are times when users might face delays or rejections in their withdrawal requests. Here are some typical issues that can arise for Exness users:

Errors in Withdrawal Information

Providing wrong or incomplete details in your withdrawal request can cause delays or mistakes in processing. This is a frequent issue for many online traders on Exness, particularly for those who manage multiple accounts or use different banking methods. It’s important to carefully review your payment information, such as names, account numbers, and specific banking method details, before submitting your withdrawal request.

Account Verification Not Complete

Withdrawals from unverified accounts on Exness may be limited due to the company’s stringent Know Your Customer (KYC) and anti-money laundering policies. These measures are in place to ensure the security of traders’ funds. To avoid delays and issues, make sure to complete the verification process of your Exness account by submitting your proof of address and valid ID documents.

Mismatched Payment Methods

Exness generally mandates that withdrawals are made through the same banking method used for deposits. Attempting to withdraw through a different method can lead to the request being declined. For example, if you deposited funds using a debit or credit card, you should also use it for withdrawals. If you need to change your withdrawal method, update your payment details in your account settings first.

Technical Issues

On rare occasions, technical problems might interfere with your ability to withdraw funds from Exness. These can include server downtime, system maintenance, or other unexpected issues. In such cases, reaching out to Exness customer support for help with your withdrawal is advisable.

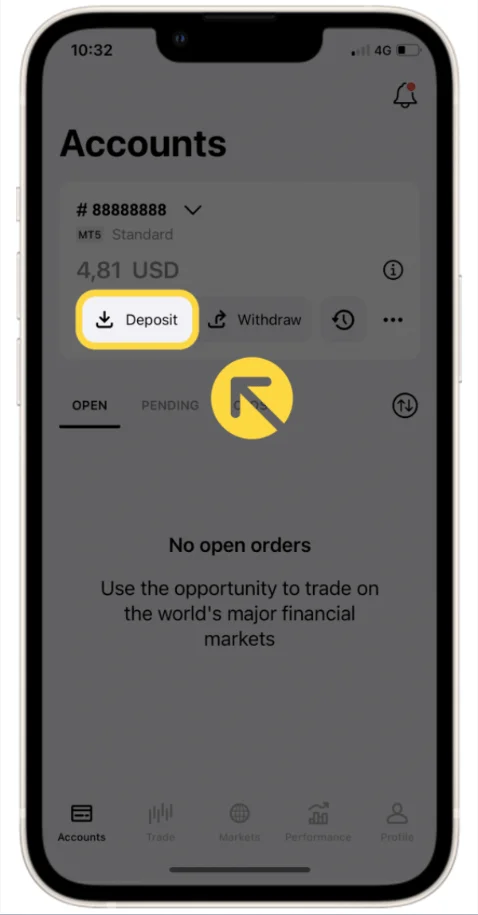

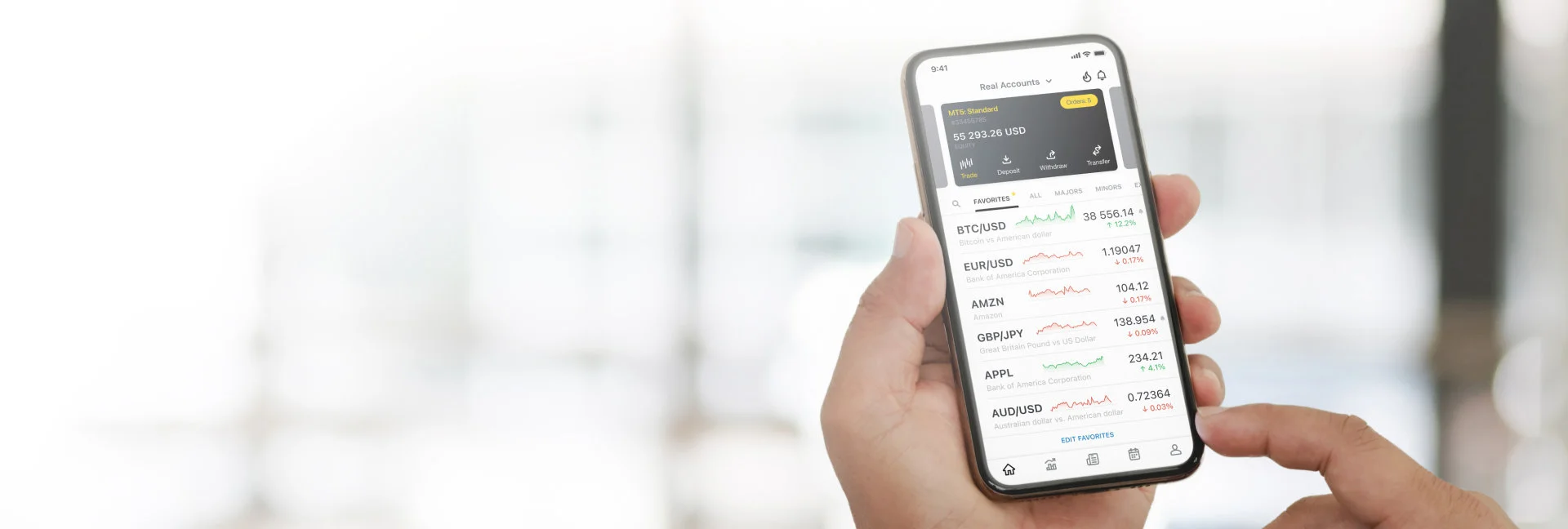

Mobile Trading with the Exness App

Exness excels in providing a dependable mobile trading application, ensuring their online traders can engage in trading activities seamlessly. This sophisticated app mirrors the desktop trading experience, catering to all levels of traders. It allows users to utilize the same features and tools available on the desktop platform right from their smartphones.

Key features of the Exness mobile app include:

- The ability to use various indicators for analyzing trading charts and applying diverse trading strategies.

- Helps traders stay informed about economic trends, interpret price patterns, and stay updated with critical market news.

- Enables management of trading accounts, including Exness demo accounts.

- Provides built-in calculators for precise calculations of swaps, spreads, and margins.

In addition to these functionalities, the Exness app supports instant deposits, offers access to over 130 financial instruments, and enables on-demand fund withdrawals. The app also includes a dedicated customer support team, ensuring that traders can confidently invest and manage their funds securely from any location.

Security Measures for Safe Transactions

Understanding the risks involved in financial investments, Exness has implemented several security measures to ensure a safe trading environment. These measures include:

Enhanced Account Protection

Exness employs a dual-layer security system for your account. The first layer involves advanced data encryption, which keeps your personal information safe and hidden from unauthorized access. This means all your shared data with Exness remains protected.

Two-Factor Authentication

Along with robust encryption, Exness has incorporated a two-factor authentication process. This requires not just your password for logging into your account but also a unique code sent to your mobile phone. This extra step verifies your identity each time you access your account, enhancing security.

Segregated Customer Funds

To further protect traders’ funds, Exness maintains segregated accounts. This means your funds are kept separate from the company’s operational funds, reducing the risk of misappropriation and ensuring transparency in handling your investments.

Adherence to KYC Norms

Exness rigorously follows Know Your Customer (KYC) regulations to confirm the identity of its traders. When setting up an account, you’re asked to provide specific documents that confirm your identity and location. This procedure helps prevent fraudulent activities, money laundering, and maintains the platform’s integrity, all while protecting the interests of its traders.

Tips for a Smooth Transaction Process

For an easy and efficient process when handling your funds on Exness, whether depositing or withdrawing, keep in mind these helpful pointers:

- Quick Account Verification: Speed up the process by providing the necessary identification documents for account verification. This step helps avoid any limitations on your transactions.

- Consistent Payment Method: Stick to the same method for both depositing and withdrawing funds to prevent complications in receiving your money.

- Account Balance Monitoring: Regularly check your account to make sure you have sufficient funds before requesting a withdrawal.

- Accuracy in Banking Details: Carefully confirm your banking information when making deposits and withdrawals to avoid any delays or errors in processing.

- Seeking Help for Technical Issues: If you run into any technical problems with your transactions, don’t hesitate to reach out to the customer support team.

Getting Support and Help

To find in-depth information or seek assistance related to Exness deposits and withdrawals, contact their professional support team and find the answers you need. The customer support team is available 24/7 and you can communicate with them via live chat, email, or phone. However, the support team will require you to provide your support PIN and account number if you already have an account.

Conclusion

Exness is dedicated to providing a smooth deposit and withdrawal experience, which is a key aspect of their appeal to global online financial traders. By adhering to the guidelines outlined here, you can manage your Exness account effectively for your trading activities. Always stay informed about the various payment methods at your disposal, and don’t hesitate to reach out to the Exness support team for any inquiries or assistance.

FAQs about Exness Payments

What deposit and withdrawal methods are available in Exness?

Exness provides several methods for deposits and withdrawals, usually including bank transfers, credit/debit cards, and e-wallets such as Skrill and Neteller. These options may differ depending on where you are located.

How do I add funds to my Exness account?

To deposit funds, sign into your Exness account, head to the ‘Deposit’ area, and pick your preferred method. This could be bank transfers, credit/debit cards, or e-wallets. Then, just follow the instructions on the screen to finalize your deposit. The time it takes for the deposit to complete might vary with the method you choose.

What’s the procedure for withdrawing from my Exness account?

For withdrawals, log in to your Exness account and visit the ‘Withdrawal’ area. Here, choose how you’d like to withdraw, input the amount, and adhere to the steps provided to finish your transaction. The time and fees for withdrawals will depend on your chosen method.

What benefits do Exness debit and Mastercard offer?

The Exness debit and Mastercard usually provide benefits such as direct access to your trading account funds, convenience in both online and physical transactions, and possibly lower fees for withdrawals. They might also allow for higher transaction limits and quicker processing times compared to other methods. However, these features can vary, so it’s advisable to check what’s available in your area.